Everywhere you look are signs the property market is as hot as ever. Capital city markets residential clearance rates are hitting all-time highs, regional markets are still riding the wave of the Federal HomeBuilder stimulus and the COVID-recovery is roaring... with a long immigration runway to boost the sector in the long term.

But who is funding the boom? Federal stimulus might be fuelling the demand-side of the equation but the supply-side of the property sector is gearing up to meet future housing expectations, including the influx of demand when immigration returns. The total commercial real estate (CRE) debt market is a $350 billion opportunity and it's growing.

Qualitas is one such investment firm looking to back developers and finance the new supply pipeline. It's also focussing on Australia's newest asset class, build-to-rent.

The target market for build-to-rent has traditionally been some 12 million young Australians who aren't ready to get on to the property ladder. While this asset class is yet to take off in Australia, in the USA, the much more established build-to-rent sector totals 31.4 million units, according to CBRE, and represented 25.8% of the total housing stock.

We recently sat down with Andrew Schwartz, co-founder and group managing director of Qualitas to find out more about build-to-rent and the private debt financing market more broadly. This powerful investment firm has circa $3 billion of funds under management and focuses on investing debt and equity into real estate with significant exposure to senior debt and mezzanine construction finance, including financing the build-to-rent sector.

Qualitas has four distinct investment strategies across the real estate sector, namely private debt, build-to-rent, opportunistic and long WALE (weighted average lease expiry). Could you just tell us a little bit about these investment strategies?

The private debt strategies really focus on senior mortgages, mezzanine debt and construction finance. So, we've got that as three distinct strategies within private debt.

The second strategy is build-to-rent, where we invest as equity sponsor as well as debt into build-to-rent projects but we don’t invest as both debt and equity into the same project to avoid conflicts of interest.

Thirdly, we run an equity opportunistic strategy which focuses more on development projects.

And then the fourth strategy is long WALE (weighted average lease expiry), which focuses on lower, more stable, reliable income streams from mature properties that have long leases.

Do you have an asset class that you're looking at the most favourably or has the most promising outlook? So from commercial to industrial, to residential?

It's very much project-specific and not a one size fits all response.

We continue to like the residential sector as its experiencing very favourable conditions particularly the land subdivision market. Much of the demand has been brought forward because of significant government incentives that have boosted the regional areas. But what we have seen is a bring forward of future volume. Our outlook is that demand will dampen but not fall off a cliff. There are a lot of pre-orders in the system that will need to be met.

The expectation is the apartment sector, which has been weak from a new development point, will swing back over the next couple of years. This will depend on borders opening up and migration returning.

Many of our partners and borrowers are buying ahead of this trend and getting ready for the next cycle which is coming. We have a significant pipeline of exciting new projects we are currently considering for capital allocation

In my view, Australia is absolutely shining through this COVID crisis. People who want to move to Australia will want to be here even more and those factors will ultimately lead to a very substantial rise in the residential market.

Commercial office, again, I think it's project-specific. It depends on where you are.

An office readjustment process is currently underway particularly in the CBD where we are seeing decentralisation out of the CBD to inner urban areas.

What I have observed to date is that when you assess the people in your office generally you can categorise employees into broadly four groups of people.

Firstly, those people who have love the office and have been very much wanting to come back.

Next are employees who wish to only return 2 or 3 days a week.

The third category of people who have made it clear that they are never coming back because they love working remotely, and lastly

There is a group of young graduates and new starters who feel the need to be in an office to learn the company culture and dynamic.

As this adjustment process works its way through on lease expiry dates and if tenants give back say 10% of their existing space it will create 1 million square meters of backfill space in Melbourne and Sydney alone. This is the equivalent to roughly 20 large office buildings being empty. Tenants will use the opportunity to upgrade their premises and this could well have a cascading effect on the bottom tier of buildings that must be repurposed.

I do believe Build to Order where large tenants pre-commit in advance will continue to occur because much of the empty office space will not be contiguous and the consolidation process will take a number of years to work through the system as tenant expiries occur and landlords seek to move tenants into smaller tenancies.

Industrial is the absolute darling of the market, particularly because online logistics have really brought that sector alive over the last couple of years, particularly through COVID.

Retail is a whole other sector, probably a little bit more challenged, but also with opportunity as well.

There was one particular strategy that I wanted to explore with you today and that's debt. So could you explain the types of debt that you're invested in?

We're invested across three different private debt strategies: one is investment debt, the second is construction debt, and we also do some mezzanine finance through some of our funds as well.

The appeal of debt is the fact that it provides known, regular income. You know what you're getting right from the outset, you have security for risk of downside. So it offers you protections that you just can't achieve through an equity investment into property. For many investors, rightly or wrongly, they're concerned about cap rate softening in a changing market.

Debt is a good place to be if you believe that some of that cap rate compression may have come out of the market going forward. So for different reasons investors find this asset class very appealing. It's a relatively new asset class in the Australian market, but certainly gaining favour with a lot of investors.

How big is the real estate debt market?

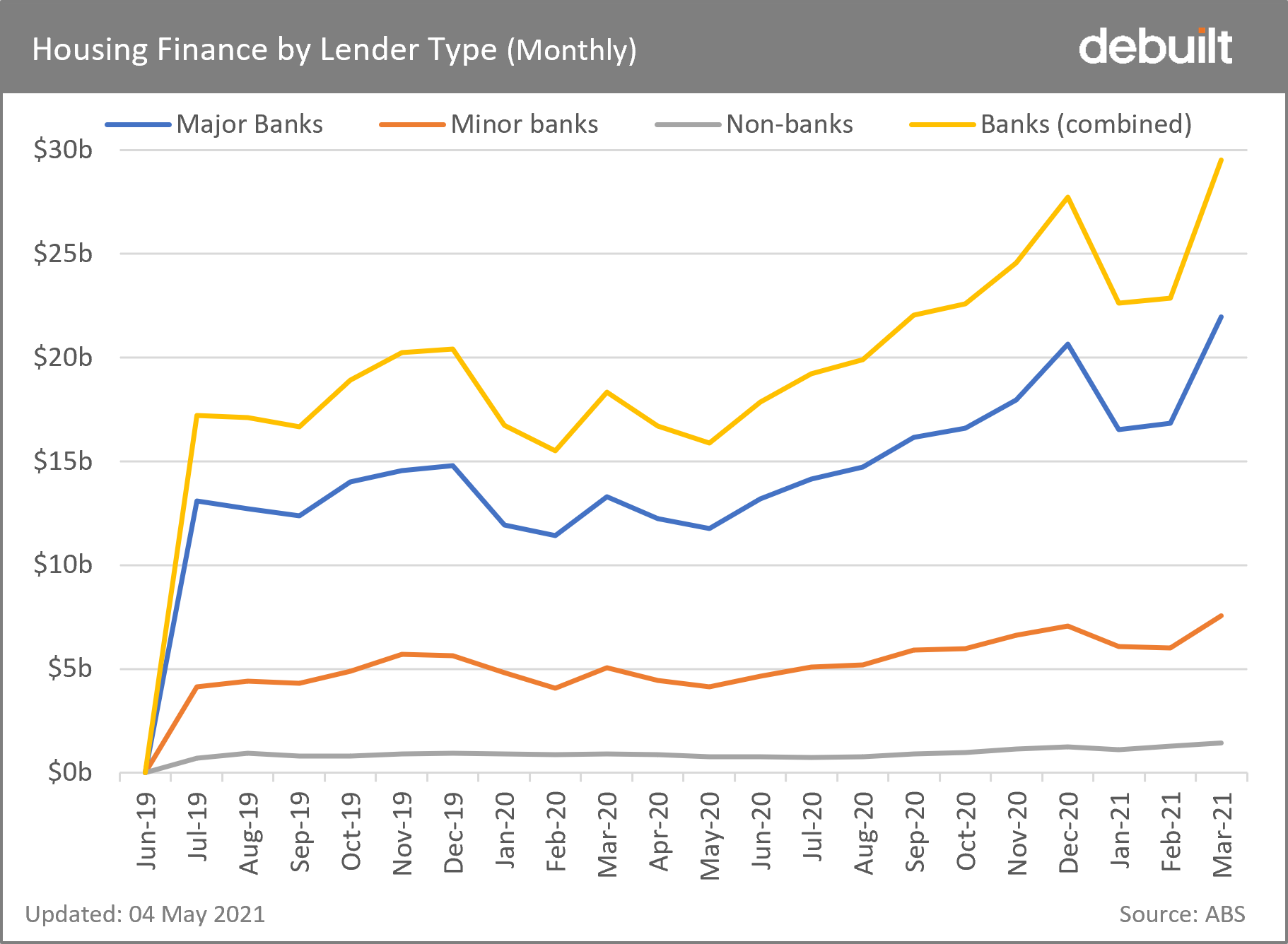

Commercial real estate (CRE) debt is estimated to be circa $350 billion noting that it excludes housing loans that the banks have, which is obviously a much larger market. But the CRE debt market is growing by about approximately 4% per annum and the non-banks, such as Qualitas, control about 6-8% of that market. This is very low compared to say the US or the UK where the non-bank market is closer to 40%.

So that 4% growth rate is quite interesting. What are some of the drivers to that?

Well, I think part of it is just rising values where the underlying real estate value goes up and therefore it can support the natural increase to debt levels without changing loan-to-value ratios in any way. Some of that growth would also be in respect of new development activities as well where people are looking to construct residential buildings or new industrial buildings so construction finance would be caught up in those numbers too.

Is there a particular driver for developers looking to go to alternative lenders like yourself as opposed to big banks?

They're really seeking greater flexibility. Alternate lenders have fewer constraints in respect of things such as debt sizing, as an example, relative to the banks. And often just the sheer speed at which a non-bank can move and its flexibility are major drivers for borrowers. I think what's changed in the past few years is for most borrowers, having a relationship with a non-bank was a nice-to-have. I would say now for borrowers it's a must-have, and it's really about ensuring that you've got a relationship with one of the major non-bank providers so that you're able to really take advantage of their total lending capability.

Can you briefly explain the build-to-rent sector for our readers? What is it?

It’s where a developer builds a large residential high-density development of at least 200 units specific for a rental market. Think of it as a "build to hold" strategy, not one based on selling the apartment but rather holding in one line purely for rental and offering integrated service and delivery.

What is it about this asset class which is appealing to you?

It’s appealing because there is a new generation of young adults who want to rent and not own. The demographic is 25-39 year olds with no real offering for that age group. It's particularly focused on the apartment product, in the location they want, with the service offering they want. We estimate that demographic is 12 million people and 50% of them rent. It’s a large demographic. It’s partly affordability but partly they have other priorities including personal flexibility or capital flexibility, so they are not tied into residential real estate as their main investment strategy.

Are you seeing a lot of interest from investors in this asset class, both in Australia and overseas?

We are seeing significant investor appetite for the sector, early adopters of this strategy, who see the value in having a diversity of income derived from a multitude of tenants. Also, office is no longer the shining asset class for the moment and residential yields are approximating office yields, allowing investors to consider residential as a long-term asset hold. To make this work you really need large scale and volume. You can’t be a private developer looking to do this once-off.

What are some of the traps of CRE debt investment for the newbies to this sector?

I think the most important aspect for new investors to CRE debt investing is that a “first mortgage” is not a homogenous investment. Terms and conditions differ, quality of the counterparties have nuances and the quality of the security differs. I sometimes have concerns that new investors don’t understand these differential points and are merely attracted to a headline rate. Thankfully at Qualitas we have a very strong track record in our debt lending, but its important for investors to note that there is no such thing as a ’free lunch’ when it comes to participating in the debt market. If you are earning a high return there is always a good reason for that occurring. The answer is not that the borrower blindly agreed to a high rate of return.

There is a direct correlation between risk and return and the market is very efficient in this regard. The market is deep and based on extensive knowledge. So the bottom line for investors is to do your homework and really question why a lender may be offering very high returns for the investors and what is the asset quality giving rise to those returns.

What are some of your key indicators for the growth of the residential debt market overall? You mentioned residential development is likely to have a huge uptick when the "immigration taps" are turned back on. Is that something you're looking at for the debt market as well?

It's definitely one indicator. I think the big driver of the market is really interest rates. The indicator that I often look at is the stability of interest rates at the current level. I think the recent comments by the Reserve Bank Governor indicating rates would stay steady for the next three years really provides a lot of confidence to property investors that rates won't run away with them and for most property holders and investors just watching the cost of capital and how that interacts with capital values is the indicator I mostly look at.

Are there any other key trends that you see or key opportunities coming up for the year ahead?

The things to really watch closely are economic growth rates as that always plays into confidence levels. We're also watching the unemployment situation within the Australian economy because employment is an indicator of spare capacity. So while unemployment remains at relatively high levels, interest rates are unlikely to rise. That's one that we watch very carefully.

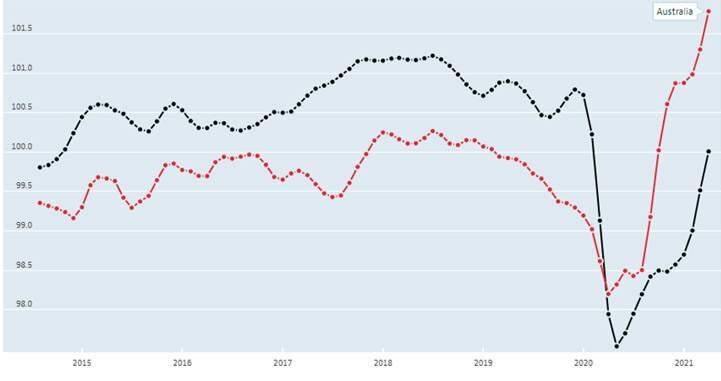

Immigration is a significant factor. For the first time in 100 years, immigration was actually running to a negative outflow.

There will be a "catch up event" that is likely to occur once the crisis, vaccination programmes and quarantine issues are resolved. There's going to be a big impetus for a catch-up event in respect of the population that should have a really positive effect on real estate. So they're all the things we're watching on the upside.

On the downside, we watch the reverse: interest rate increases, tightening of employment levels, reducing spare capacity in the economy, lack of investor confidence, lack of consumer confidence, the profitability of businesses reducing across the board. They're the top indicators we’re watching on the downside risk.

![190815_AMPCapital_ShaneOliver_715[66].jpg](https://images.squarespace-cdn.com/content/v1/5c197a32b105982976e5e89b/1619054377539-39PFJHMNFUQFNYFQ9WWI/190815_AMPCapital_ShaneOliver_715%5B66%5D.jpg)