Paul is a co-founder and director of Debuilt Property. Paul has extensive experience in construction, project management, development management and asset management.

As HomeBuilder and other government stimulus begin to wind down, the industry is slowly steadying. All trends throughout February and March appear to be linked – building approvals continue their record climb, while home loan commitments saw their fastest increase since July 2003.

Dwelling approvals

The number of dwellings approved nationally rose 17.4% in March, following a 20.1% rise in February. This is evidence of heightened market activity, and can be partly attributed to lower borrowing costs.

However, the proportion of houses versus apartments approved varied from state to state. Victoria had a significantly larger number of houses approved, whereas NSW saw apartment approvals skyrocket. This is likely due to preferences shifting to smaller dwellings as Sydney’s property prices increase.

Dwellings commenced

Dwelling commencements varied state-by-state in Q4-2020, with Western Australia seeing the most dramatic increases to December, surging past its 2018 peak to hit an all-time high. Queensland, NSW and Victoria all saw increases in commencements, but are not yet returning to peak levels like WA. It is likely the HomeBuilder and First Home Owner Grant stimuli assisted with the increased levels.

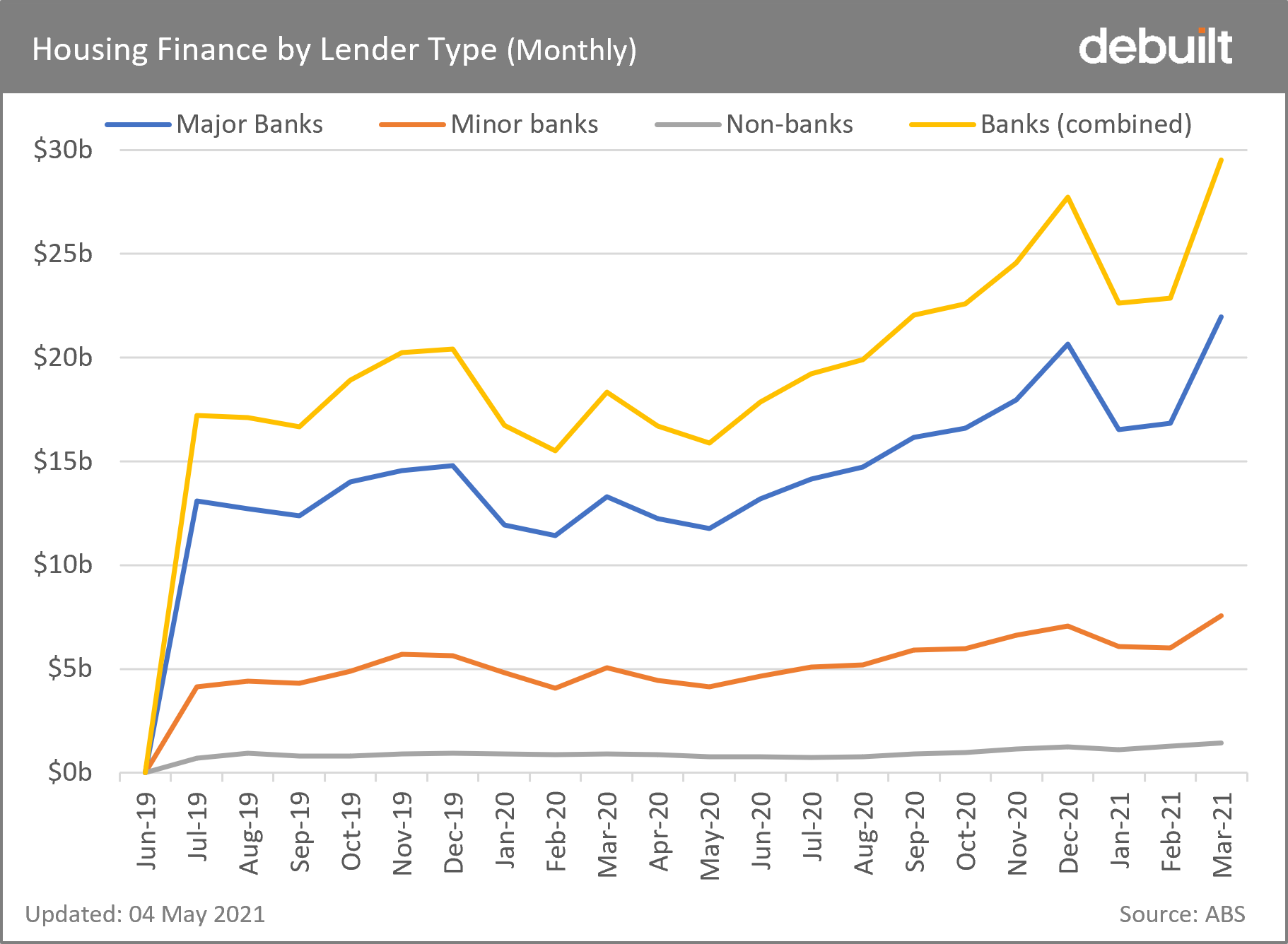

Housing Finance

New loan commitments for housing rose 5.5% in March 2021 to a new record high of $30.2 billion. This rise is the largest recorded since July 2003 and was driven by increased loan commitments to investors for existing dwellings. Major banks experienced the largest increase in lending, with a 30.5% rise since February. Minor banks also increased quite dramatically by 25.6%. Non-bank loan commitments rose 12.2% compared to February.

Lending for housing is a good indicator of dwelling price movements. House price gains are significantly higher than the historical average monthly rate of growth.

Experts suggest that consumers are searching for lenders who provide high-quality online products and services, something which is common amongst smaller non-bank lenders, as a result of the Covid-19 pandemic. Non-bank lenders also often have shorter processing and approval times, and during the pandemic, people have found more time to shop around to find the best online deals.

Lending to investors accounted for more than half of the March rise in housing loan commitments, with a 37.5% rise in value in March. The value for owner-occupiers grew 25.4% in March.