As Director of Residential at Savills, Chris is responsible for the strategy & operation of its residential business. With a diverse experience in the industry as a business owner, salesperson, property manager & trainer, his insight across multiple markets has given him a unique approach to the way he looks at the industry today. With the backing of the Savills brand and its international network of operators, Chris is focused on delivering a world-class agency services business to enable his team and customers to reach their personal goals.

Historically when we look at different property markets, there have always been underlying drivers determining a region or local area’s popularity and subsequent increase or decrease in values.

It’s this popularity or supply and demand dynamic that creates the ebb and flow of values we call ‘the market’, which is typically dictated by factors such as employment, infrastructure and housing supply.

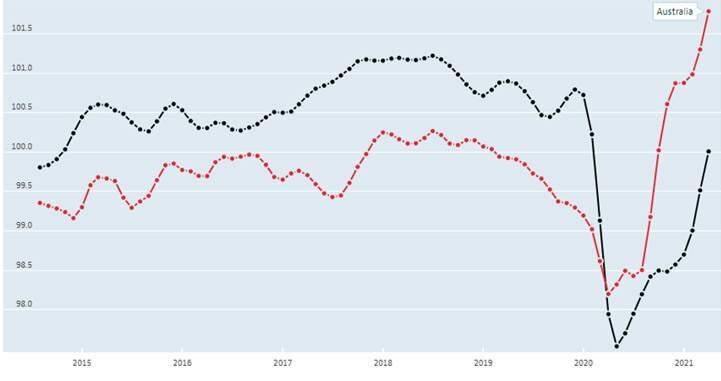

According to the OECD (Organisation for Economic Co-operation and Development) Consumer Confidence Index which provides indicative household sentiment, Australia is currently above 100 on the index which means that as a whole, our outlook toward the future economic situation is very positive. This is the first time since 2010 that our economic sentiment has been as high. Compared to the OECD baseline, our collective community is showing a much more positive outlook than many other countries in contrast to historic sentiment, which languished in comparison.

OECD Consumer Confidence Index (CCI) Amplitude adjusted, Long- term average + 100, Jane 2014 – Apr 2021

During 2020 the OECD CCI recorded a sharp decline in consumer sentiment as a direct result of the unknown outcome of the global pandemic and the imposed lockdowns. We were able to see clear trends in confidence levels that relate to consumer spending habits and buyer sentiment in the Australian property market as a flow on effect. With confidence levels regaining record highs, cheaper interest rates, banking deregulation and a need for more space, it’s easy to see why the local residential property market has continued to gain momentum.

SO HOW DO SHORTER LOCKDOWNS COMPARE TO LONGER ONES?

According to Roy Morgan research, shorter lockdowns as an isolated event do not impact the long-term sentiment of consumers. However, the data that we don’t yet have access to relates to the flow on effect of deferred investment, future unemployment and localised spending habits of those impacted as a result of an extended or repeat lockdown environment.

Some data that we do have and a key leading indicator to localised sentiment is interstate migration, where we either see a rise or fall in households moving between states for various reasons (excluding emigration from foreign countries). The following Australian Bureau of Statistics (ABS) data shows a change in the trend of migration pattern away from Victoria for the period in 2020 when a 111 day lockdown was endured. With an increased net growth to other states during this time, there was an underlying trend of migration away from the state in lockdown. While this data can’t be considered as a sole indication of the Victorian population sentiment (as we also see consistent negative net growth for NSW), it does show a clear change in migration patterns specific to Victoria that are relative to the timing of lockdowns.

ABS Interstage Migration data

WHY IS MIGRATION IMPORTANT?

There are a few things to consider when the population shrinks after a significant financial event. Put simply, if there are less people to occupy the property that currently exists and less businesses thriving which will impact future local employment, supply and demand will dictate that property values will decline without external stimulus.

The main learning for most of us from the initial lockdowns is that the office culture is changing, and we have seen a hybrid model of working from home emerge. This means that many are able to move to other areas and maintain current employment, fuelling price growth in regional markets and further exacerbating migration patterns. The Metropolitan markets however have seen a trend toward size; four bedrooms is the new three bedrooms, as many work from home and are in need of more space or flexible space to work from.

With a combined value of AU$8.1 trillion, the Australian residential property market is the single largest asset class in our economy and one that represents the majority of household wealth. This evidently is part of the very culture we embody of the great Australian dream and is fundamental to the majority of the population’s wealth and retirement strategy.

With this in mind, lockdowns are no longer just about stopping the spread of a pandemic. They are changing the very fabric of our economy in ways that we don’t yet understand.