By Anthony Veal Adjunct Professor, Business School, University of Technology Sydney and Awais Piracha Associate Professor of Urban Planning, Director Academic Programs, Geography Tourism and Urban Planning, Western Sydney University

Growing populations and housing shortages are affecting cities worldwide, including in Australia. It’s driving them to adopt high-density development near public transport hubs instead of endless suburban sprawl on city fringes.

In Sydney, the state government has plans for transport-oriented developments within 400 metres of 37 existing train stations. These will include 170,000 new dwellings.

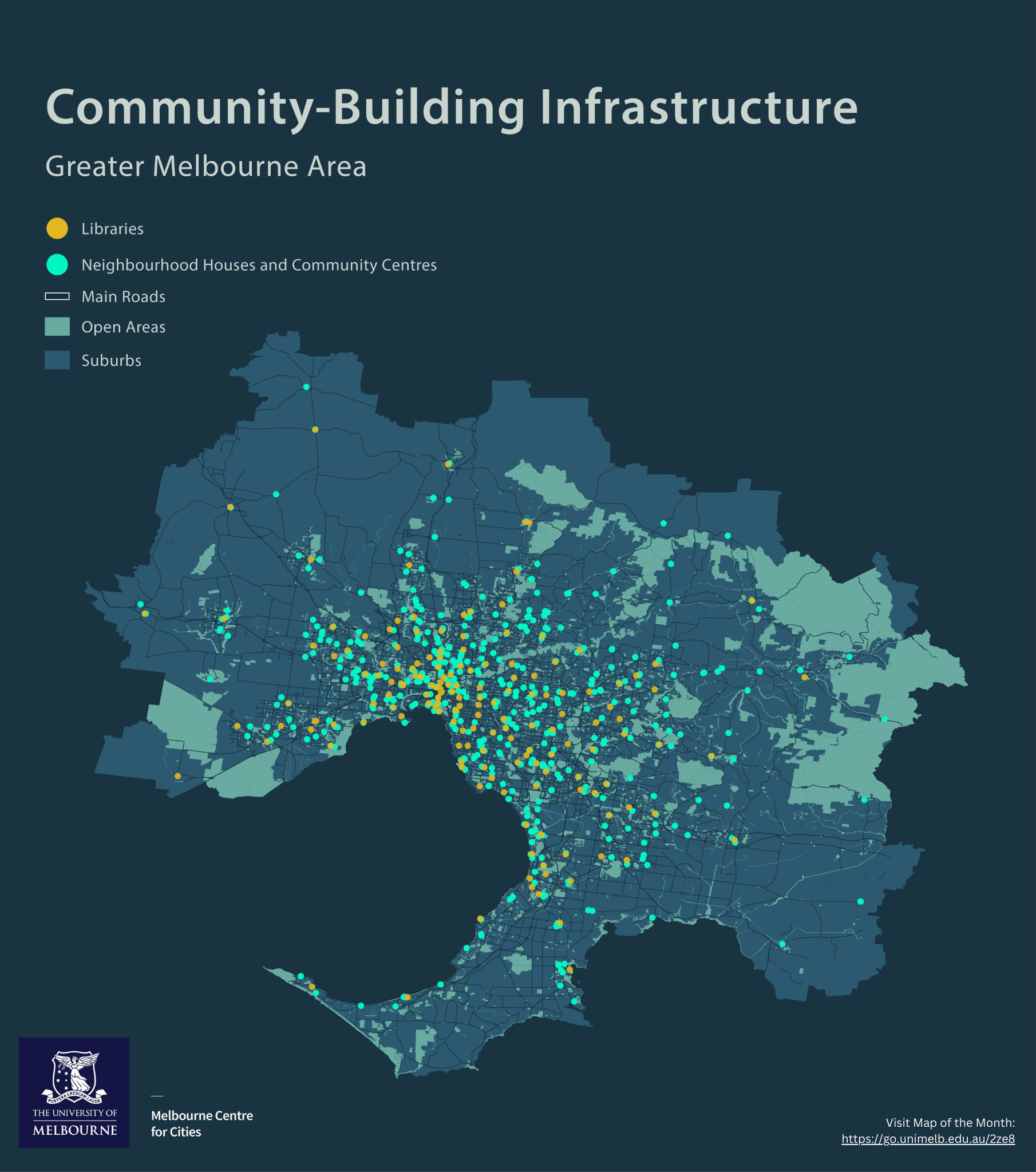

In Melbourne, work has begun on a massive project, the Suburban Rail Loop. In the first of four stages (SRL East), 70,000 dwellings will be built around six new stations.

These developments pose unique challenges for urban planners. In particular, residents of these higher-density precincts will still need public open space and recreation facilities.

Communities and local councils are concerned higher residential densities will increase pressures on infrastructure, services and open space. Local residents often oppose such developments. They fear these new, denser communities may lack vital infrastructure and services, shifting the burden of meeting these needs onto neighbouring areas.

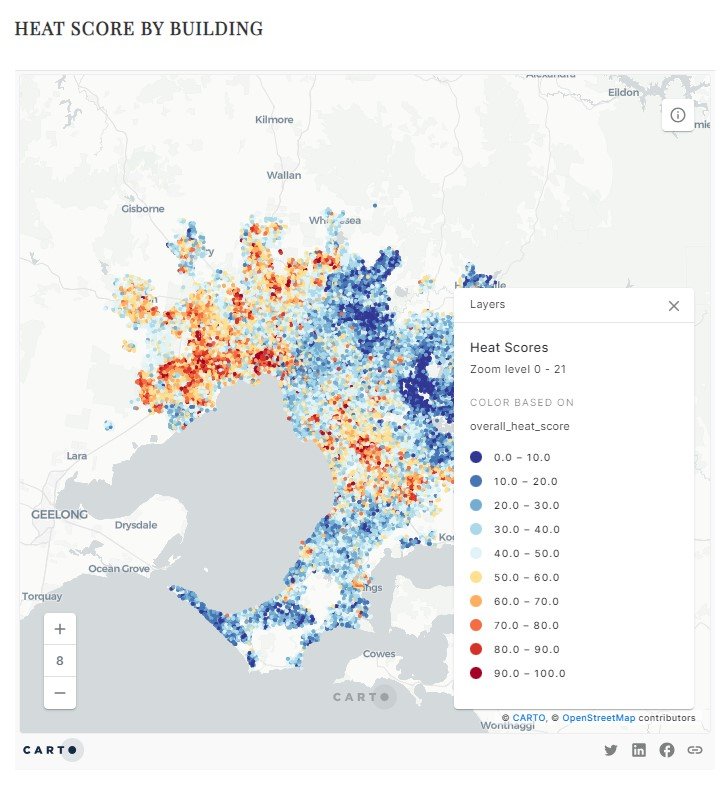

Open spaces are crucial for physical activity and an attractive and healthy urban environment. However, traditional methods of planning open space are designed for lower-density suburbs. They struggle to meet residents’ recreational needs in high-density areas.

We’ve developed a new planning tool to help ensure higher-density developments provide enough recreational space.

High density challenges traditional planning

We reviewed open space and recreation planning methods around the world and assessed their suitability for meeting recreational needs in high-density areas.

The most common “standards” method specifies a certain area of open space, such as hectares per 1,000 population. Our review found it has been criticised for its “one size fits all” approach and lack of supporting research evidence. The approach may work in low-density suburbs but not in high-density areas that simply don’t have enough open space to meet the specified standard.

Another traditional approach is the “demand-based” model. It relies on consultation with an existing population.

But the population of the transport-oriented development is not resident at the time of planning. It’s also likely to differ from the surrounding population – for example, in age structure.

A better approach is needed. Our solution is the Recreational Activity Benchmark (RAB) model.

This model focuses on the new population’s likely level of recreation participation. This benchmark is based on anticipated characteristics of the new residents, such as age structure, and associated recreation patterns. Existing survey data from across the metropolitan area indicate the patterns we can expect.

A mix of strategies is needed

To meet this benchmark level of recreation demand in the limited space available requires a mix of strategies.

The first strategy is to rely more on indoor facilities such as sports halls, gyms and swimming pools. These allow for high levels of physical activity using much less land than traditional playing fields. They can be open for longer hours, are unaffected by weather and can be built as part of high-density, multi-purpose developments.

The second strategy is repurposing non-traditional open spaces for recreation. In particular, designing streets, footpaths and pavements as pleasant green areas encourages walking and cycling. Maintaining these areas for such activities thus also provides for recreation.

As part of this strategy, rooftops, school yards and other unconventional areas can be transformed into active recreation zones. Cities around the world have used innovative design solutions.

Singapore’s Dual-Use Scheme opens school yards to the public after hours. Seoul has creatively transformed a former highway overpass into an attractive walkway and public space.

A highway overpass was turned into the Seoul Skygarden running through the congested heart of the city. Sagase48/Shutterstock

Other solutions include green streets, vertical gardens, multi-functional street furniture and water features.

Specific examples include Tokyo’s “green roads” and Seoul’s street workout stations. The Singapore Sports Hub employs a dedicated team to offer diverse activities, making the best use of limited space.

These solutions all help meet physical recreation needs in high-density developments. The limited amount of open space can then be reserved for informal recreation, such as walking and quiet contemplation.

In Japan, green roads integrate greenery along the road with surrounding green spaces. photoK-jp/Shutterstock

Making sure recreation needs will be met

Higher-density development around transport hubs aims to overcome housing shortages and avoid the harmful impacts of urban sprawl. Our planning tool can help overcome community concerns about these developments lacking spaces for recreation.

This tool establishes a benchmark recreational activity level derived from participation rates per person across the metropolitan area. It calculates the land needed to support recreation and reallocates participation to activities that require less land or can be done indoors. In this way, it ensures high-density areas can still meet residents’ recreational needs.

The RAB model enables planners to produce a range of possible scenarios. Different mixes of facilities and activities can be flexibly developed to suit different local environments and different anticipated resident populations.

This article was originally published on The Conversation. Read it here.