Arif Uzay joined Rider Levett Bucknall in 2002 as a cadet quantity surveyor, promoted to an associate in 2010 and in 2017 was appointed as a director. He is passionate about the built environment, diversity and inclusion within the construction industry, and contributing to change. Arif also demonstrates a comprehensive understanding of financial and cost management, specialising in conceptual estimating, cost planning, construction services and project procurement. He has considerable experience providing services for both the Government and the private sector on a broad range of construction projects and industries.

The construction industry directly employs almost 1 in 10 Australians across approximately 400,000 businesses. It generates over $360 billion in revenue annually, making it responsible for around 9% of Australia’s Gross Domestic Product. According to data published by the Australian Industry and Skills Commission in January 2022, this revenue is projected to grow by 2.4% in the next five years. Clearly, the construction industry is a significant contributor to Australia’s economy.

However, the industry is set to face an increasingly challenging environment. All RLB offices are predicting market pricing volatility due to supply chain instability, rising shipping costs, changing labour dynamics and increasing material costs.

Remarkable Resilience

Prior to the outbreak of the COVID-19 pandemic, the construction industry was expecting relatively stable volumes of work over 2020, 2021 and into 2022. Analysts were predicting a slight drop in activity in the major centres after the record levels of construction during 2018 and 2019. Escalation was following the Consumer Price Index (CPI) pattern of relative stability in all major cities, with only minor activity fluctuations.

Since the outbreak of the COVID-19 pandemic, the construction industry has shown remarkable resilience. This is partly because the industry was classified as ‘essential’ by state governments. For the most part, this classification created a stable working environment, enabling the completion of existing projects, and the commencement of new projects.

The total value of approvals in Australia rose by 16.3% ($28 billion) for the 2021 financial year (FY 21) compared to the 2020 financial year (FY 20). Significant upturns (above 15%) were seen in approval levels in all states except Victoria (up 2.5%). For the seven months to January 2022, approval levels were 9.4% higher than the corresponding period in 2021.

In the first quarter of 2022, 95 cranes were added to Australia’s skyline, taking the total to 813 cranes across the nation. This is the highest number of cranes recorded since the inception of the RLB Crane Index in 2012.

Forecasts for 2022 indicate that the construction industry is in a positive phase. It is likely that volumes of work will increase in the coming years, with significant construction activity in road, rail, health and social and affordable housing projects.

An Increasingly Challenging Operating Environment

Despite this positive activity, the first quarter of 2022 has given rise to an increasingly challenging operating environment. Several factors are expected to affect the construction industry over the short, medium and long term, all of which have the potential to greatly impact cost, time and availability of resources. However, the quantum cannot yet be determined.

Supply Chain Issues

Fragmented supply chain issues are still not resolved. The lead time for some international products is traditionally 8 to 10 weeks. It is currently 16 to 20 weeks, and in many cases longer. Stunning satellite footage released in April reveals the extent of the global shipping backlog, with thousands of ships moored offshore near Shanghai’s port.

Labour Shortages

Construction job vacancies have increased by a massive 80% since late 2019. And, according to Infrastructure Australia’s latest projections, by mid-2023, employment will need to grow from 183,000 people to more than 288,000. The potential shortfall in jobs is forecast to exceed 105,000 people, with one in three jobs advertised going unfilled. This shortfall is across all occupations, from engineers and project managers, to skilled tradesmen. Skills demand is 48% higher than supply.

As a result, contractor and subcontractor resources are stretched to the limit. This is making contractors and subcontractors much more selective in their tenders and causing project delays. It could also lead to increased wage pressures. The slow reopening of Australia's borders may offset some of these labour shortages, if skilled migrant numbers increase.

State and Federal Elections

The 2022 federal election, and state elections in Victoria and South Australia, will impact public sector investment, albeit at the long term cost of ever increasing account deficits. However, it is expected that all governments will continue to support the economy by investing in infrastructure.

Interest Rate Rises

In response to the highest inflation readings in nearly 40 years, the Reserve Bank of Australia lifted interest rates by 25 basis points in May. It has been tipped that this could increase to as much as 40 basis points by June. The interest rate rise is likely to quench the overly heated domestic housing market to some degree, with household borrowing power reduced. It could also impact contractors and subcontractors, affecting the cost of materials, cashflow and business borrowing power.

Global Geopolitical Escalations

The conflict in the Ukraine is generating flow on effects such as higher fuel prices, potential timber shortages due to unstable imports from Baltic nations, and a generally very unsettled geopolitical landscape. It is too early to determine the long-term impacts of the conflict. However, it is clear that these impacts are likely to linger for some time yet.

In addition, the zero COVID-19 policy and its associated lockdowns adopted in China are impacting factory production and global supply chains.

Natural Disasters

The economic cost of the flood damage on the eastern seaboard is yet to be fully understood, with forecasters predicting more rain in already saturated areas. Pressure will be seen in the need for additional materials, plant and labour for the rebuilding efforts within communities across New South Wales and Queensland.

The Effect on Tender Pricing

Pressure on tender pricing continues across Australia. There have been material price increases for cement, steel, PVC based products, timber, joinery, reinforcement and other metal based products. Some commentators suggest that building material costs in aggregate are up 20.4% over the last year, and 31.3% since January 2020. And, these prices are expected to rise throughout 2022.

This has prompted some trades to specify supply rates as a condition of tender pricing, resulting in a price adjustment should supply rates increase. Similarly, hold prices from some steel suppliers have diminished, with increases of 20% observed since October 2020. In Victoria, tender validities are being qualified at 30/60 days versus 90/120 days.

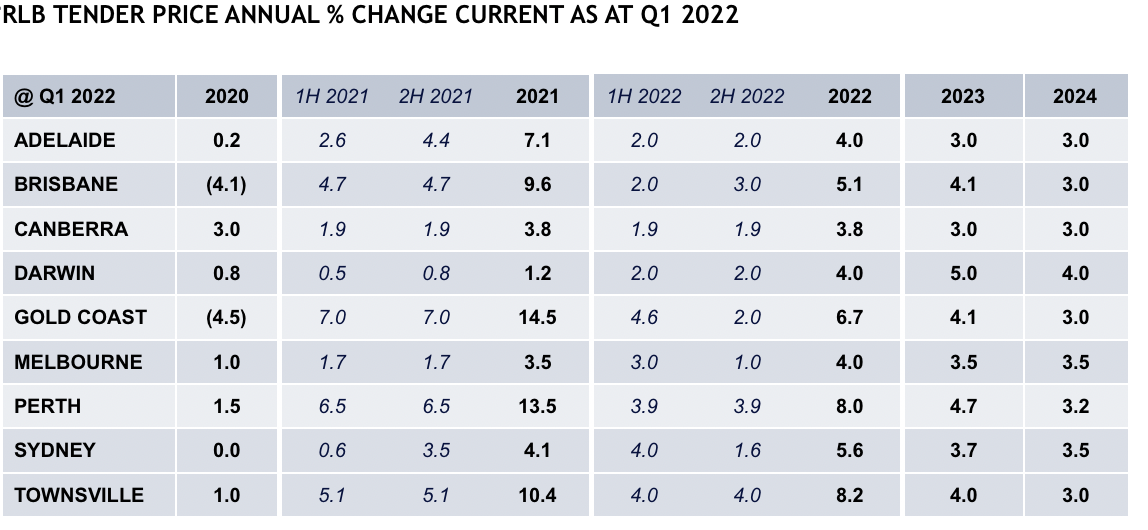

Significant surges in tender pricing have been experienced in Queensland and Perth where escalation uplifts for 2021 and 2022 are well above levels forecast at June 2021. Across the other states, it is a similar story, with levels also above those forecast six months ago.

As expected, these market conditions are flowing through into subcontractors. Head contractors have reported volatile pricing from the subcontract market, difficulty in pinning down pricing and subcontractors being selective in providing tenders. This is because the subcontractors are at capacity or unable to secure labour should their workloads increase.

Note: RLB’s Tender price Index uplifts for Q2 2022 and the remainder of 2022 are presently being revised and will be made available in the Rider Levett Bucknall Q2 2022 International Report that will be published mid-June 2022. The publication will be available from the Insights dropdown on the www.rlb.com website

Conclusion

Looking ahead, all RLB offices are predicting continued market pricing volatility due to the factors identified above. The quantum of construction escalation for the foreseeable future is very difficult to calculate as all factors influencing construction pricing is dynamic at present, and changing constantly. RLB is not alone in this conundrum. The global construction community is experiencing similar influences we are seeing in Australia, instability in supply chains, changing labour conditions and increasing material costs, all key factors in forecasting construction cost movement.