Richard Temlett is an Associate Director in Charter Keck Cramer's Strategic Research department. A former lawyer, Richard exercises an evidence-based approach when validating investment and development decisions. Richard gives insight into how the divide between supply & demand will affect Melbourne housing over the next few years.

COVID-19 has caused a substantial demand-side shock to the Melbourne housing market. There is likely to be a mismatch between supply and demand over the next 2-4 years and this will be exacerbated by rising construction costs and increasing interest rates.

Introduction

The Australian economy has undergone significant disruption as a result of COVID -19 through 2020-2022. On balance however, the economy has performed far better than expected at the commencement of the pandemic and this is due to an unprecedented level of monetary and fiscal policy stimulus provided over 2020 and 2021.

The demand-side shock caused by COVID-19, as well as the monetary and fiscal stimulus, has had a substantial impact on the demand for and supply of housing across Australia and Melbourne. Some of the impacts as they apply to the Melbourne housing market are highlighted below.

Demand-Side Impacts

It is important to keep in mind that population growth drives the demand for additional and diverse forms of dwellings and has been a major driver of the Melbourne housing market over the last two decades.

In the period prior to COVID -19, population growth was extremely strong in Victoria (peaking at 150,000 p.a) and Melbourne (peaking at 130,000 p.a). COVID -19 has had the greatest impact on the inner-city apartment market in Melbourne due to this sub-market’s large reliance on migrants and students. Population growth in Victoria has fallen to a negative 44,700 in FY 2021 whilst population growth in Melbourne has fallen to a negative 49,000 in FY 2021.

On a positive note, population growth is anticipated to return to both Victoria and Melbourne from 2023/24 onwards as the State and City are still very attractive places to live. Charter notes that Victoria will be the fastest growing State in Australia from 2023/24 and Melbourne is forecast to be larger than Sydney by 2029.

Supply-Side Impacts

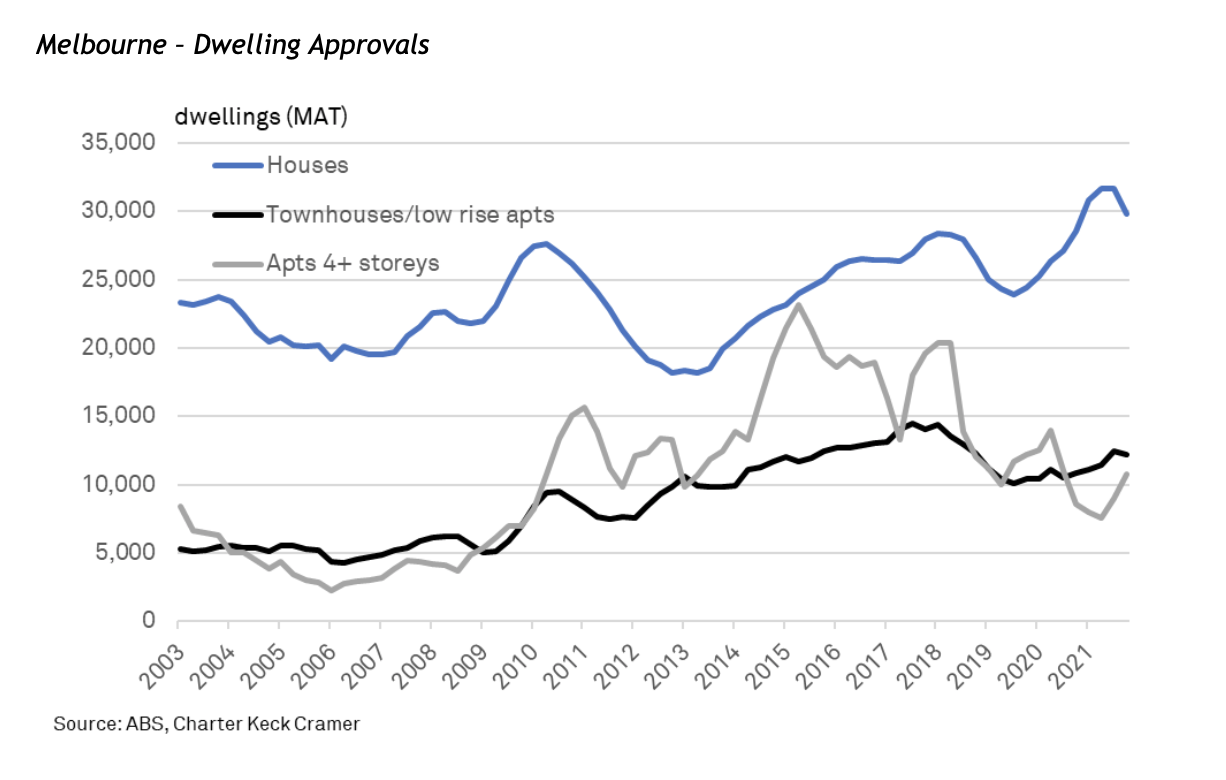

The chart below shows the building activity of new dwellings across Melbourne for the period March 2003-March 2022. Building approvals are an indicator of future supply of dwellings to enter the market and it is important to understand in more detail which types of dwellings are being delivered across Melbourne.

New dwelling activity peaked between 2016-2018 and was driven by the local and overseas investor markets during this time. Prior to COVID -19, there was a strong decline in supply (underpinned by reduced releases) as the market adjusted to increased policies targeting local and overseas investors, overarching market softening created by the uncertainty of the Banking Royal Commission as well as the Federal Election.

Charter observes that the detached housing market has been the primary beneficiary of the unprecedented monetary and fiscal policy response over 2020 and 2021 in response to COVID-19. This was because the various incentives (particularly Homebuilder) had construction commencement timing requirements that the detached housing market was able to meet.

The apartment market, for the most part, was not able to take advantage of these incentives and also was at the disadvantage of relying on investors (both local and foreign) to support presales prior to many projects obtaining construction finance. Investors were initially more cautious at the commencement of COVID -19 although they have entered the housing market over 2021 and 2022.

Prices

The chart below shows the median house and unit (townhouses and apartments) prices across Melbourne for the period March 2005-March 2022. Established house prices are a reflection of the demand / supply balance and set the context in which more affordable dwellings such as townhouses and apartments can feasibly be delivered in a market.

Melbourne’s median house price rose by +66% between June 2012 and its peak of $903,000 in December 2017. Following a softening across the market the median house price recorded a new peak of $1,076,800 as at March 2022. The median unit price recorded $659,100 as at March 2022 and represented a -39% discount to the median house price.

As highlighted above, the Melbourne housing market recorded significant price growth as a result of several factors including the COVID-19 related monetary and fiscal policies. Between June 2020 and March 2022 median house price growth was recorded at +24%. Median unit prices have recorded robust price growth although not to the extent of that recorded across the housing market (+13% growth).

Charter notes that unit prices track house prices. If one dwelling type increases or decreases in value, the market does recalibrate and the other dwelling type will subsequently increase or decrease in value. The gap between house and unit prices is currently extremely large and it is anticipated that in various sub-markets there will be price growth in units in Melbourne over the next 12 months.

Construction Costs

Charter has considered the price indices of residential housing across Melbourne to understand the change in prices across various materials used in the construction of housing.

Price increases across various items are the highest since the introduction of the GST in 2000 (or in some instances since the GFC in 2008/2009). This has led to an overall increase in costs across Melbourne (across all price groups tracked by the ABS) of +15.4% since the start of COVID-19.

Charter’s investigations with the industry suggest that to date revenue increases in the greenfield markets have been greater than cost increases and these costs have been able to be passed on to the purchaser in the form of higher prices. This is not the case in the medium and high-density space where revenues have not increased as much as costs and projects are no longer feasible.

Finally, industry sentiment is that house building costs will increase by around another +10-15% over the next 12 months and there is tremendous uncertainty with respect to the impact of China's COVID-zero policy, as well with the war in Ukraine.

Outlook

There is a lot of uncertainty in the housing market at present. Some of the key local factors causing this uncertainty and negative sentiment include rising interest rates, increasing construction costs as well as inflation whereas the global factors include the war in Ukraine, the Chinese Covid-zero policy and Global inflation.

The figures outlined in this article show that demand (both renter and buyer) will return in large numbers from 2023/24 whilst the supply of dwellings is slowing (and is likely to slow even further) over the next few years. It is important to keep in mind that supply takes time to mobilise and will not be able to quickly respond to returning demand.

This presents both risks and opportunities across various sub-markets of which developers, financiers, investors, owner-occupiers and renters need to be aware.